This dynamic nature of choices lets you craft a place to suit your actual market view. Maybe there’s an enormous Federal Reserve assembly developing and also you anticipate the market to overreact, however you don’t have a particular view as to which route. On this case, you need to use a market-neutral possibility unfold like a straddle or strangle.

In the identical vein, if the monetary media and merchants are making an enormous stink about one thing you deem a nothingburger, you need to use strangles or straddles to take the view that the market will underreact to the information in comparison with what the market pricing expects.

Strangles and straddles are market-neutral choices spreads that are apathetic to the route that worth strikes. They as a substitute permit a dealer to precise a view on the magnitude of the value transfer, regardless if the value strikes up or down.

Let’s paint a fast hypothetical for demonstration.

There’s a Federal Reserve assembly in every week. There’s tons of speak about the potential for a Fed pivot and the dramatic implications that’d have for the worldwide economic system. Trying on the S&P 500 choices for that expiration, you see that the implied volatility could be very excessive in comparison with previous Fed conferences. Merchants expect the Fed to drop a shock in some sense.

Based mostly by yourself macro view, you’re unconvinced. You imagine the Fed will proceed their marketing campaign of modest hikes of charges by the primary half the 12 months. In different phrases, you anticipate enterprise as ordinary whereas the market expects radical change.

As an choices dealer, you’re absolutely conscious that change equals volatility and the shortage of change leads volatility to contract, making most choices expire nugatory. You determine to promote a straddle, which entails promoting an at-the-money put and an at-the-money name concurrently. Ought to your view pan out, you’ll be capable to pocket a superb portion of the premium you collected once you opened the commerce.

What Is a Strangle?

A strangle is market-neutral choices unfold that entails the simultaneous buy or sale of an out-of-the-money name and an out-of-the-money put. So if the underlying is buying and selling at $20.00, you would possibly purchase the $18 strike put and the $22 strike name.

On this case, you’re hoping for a big worth transfer in both route, as your break-even worth is usually fairly removed from the present underlying worth.

Let’s have a look at a quick instance of a lengthy strangle in $SPY utilizing a .30 delta put and name with 27 days to expiration. Right here’s the choices we’re shopping for:

● SPY (underlying) worth: 396.00

● 1 386 FEB 27 PUT @ 4.31 (-0.30 delta)

● 1 407 FEB 27 CALL @ 3.54 (0.30 delta)

● Value of Place: 7.85

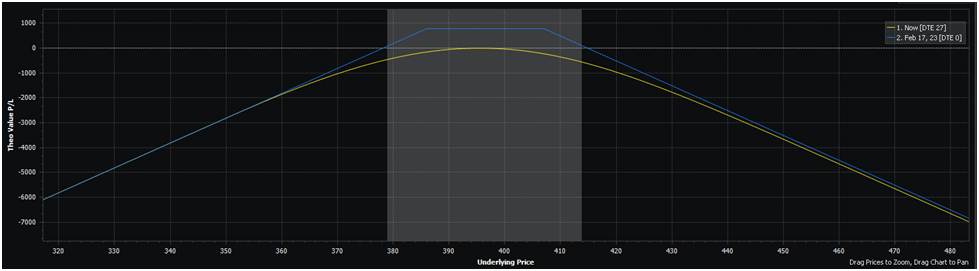

Right here’s the payoff diagram of this place:

As soon as the place will get outdoors of the shaded grey space, the place is in-the-money. To supply some context to this place, SPY should transfer up or down roughly 4.5% in your place to be in-the-money.

Let’s have a look at the identical commerce however from the brief facet:

The main points of this commerce are a mirror reverse of the earlier instance. You’d acquire a $7.85 credit score, and your break-even ranges are outdoors of the shaded grey space. You’d make this commerce in the event you anticipate SPY to stay inside that vary by expiration (27 days).

Strangle Strike Choice

Strike choice is a major issue right here and there’s no right reply actually.

The decrease delta choices you select, the cheaper the unfold and the decrease the chance of revenue will probably be. Maybe you’ve a really particular market view, making strike choice apparent. However most often, novice possibility merchants select arbitrary strikes, which is a mistake. Strike choice is without doubt one of the most essential features of commerce structuring.

A straightforward method to begin being extra considerate about choosing strikes is to view an possibility’s delta as a tough approximation of the chance of expiring in-the-money. This easy trick offers a whole lot of context to possibility pricing.

You’ll see at-the-money choices usually hover round .50 delta, as a result of the market mainly has a 50/50 probability of going up or down over any time interval not measured in years. As you get farther from the cash, deltas go down, which additionally makes intuitive sense.

Utilizing this framework, you possibly can have a look at a .20 delta strangle and suppose “the market thinks there’s a 20% probability of both of those choices expiring in-the-money. Is my chance forecast larger or decrease than that? In case you can reply this query, your strike choice turns into not solely simpler, however much more considerate.

What’s a Straddle?

A straddle is a market-neutral choices unfold involving the simultaneous buy (or sale) of a name and put on the similar strike worth and expiration. The purpose of the commerce is to make a wager on volatility in a market-neutral trend.

Whereas any commerce commerce involving shopping for or promoting a put and a name on the similar strike worth and expiration is technically a straddle, the vast majority of the time once we speak about straddles, we’re speaking about an at-the-money straddle, which means you purchase a put and name on the ATM strike.

In different phrases, if implied volatility is 20%, however you anticipate future realized volatility to be a lot larger than that, shopping for a straddle would supply a revenue no matter which route the market goes, or the way it arrives there.

Alongside comparable traces, in the event you anticipate realized volatility to be far lower than 20%, you possibly can brief a straddle to revenue from the market’s overestimation of volatility.

In a phrase, you need to purchase a protracted straddle once you suppose choices are too low-cost, and brief straddles or brief strangles when choices appear too costly.

Right here’s an instance of a lengthy straddle in SPY with 27 days to expiration. With SPY buying and selling at 396 on the time of writing, we’d need to purchase the 396 name and places. Right here’s how that’d look:

● SPY (underlying) at 396.00

● 1 396 FEB 27 CALL @ 8.59

● 1 396 FEB 27 CALL @ 7.69

● Complete price of commerce: $16.28

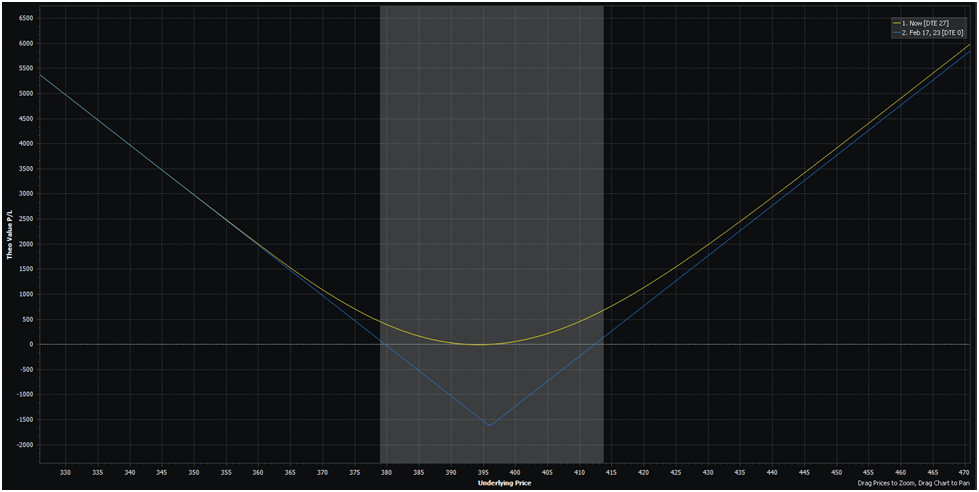

As you possibly can see, this ATM straddle prices greater than double what our 0.30 delta strangle prices us. Being fallacious on straddles is way extra painful. However this payoff diagram reveals us the upside to this trade-off:

What’s most fascinating right here is that our 0.30 delta strangle from the earlier instance has almost equivalent break-even factors to this ATM straddle: round 379 and 414. Nevertheless, trying on the form of the P&L, you possibly can see that you simply solely expertise your max P&L loss if the market goes completely nowhere and continues to be at 396 at expiration.

If the market strikes even modestly in both route, your commerce begins to maneuver in your favor. That is in stark distinction to our strangle, by which we expertise most loss at a far wider vary of costs.

So when you do should shell out extra premium to determine a straddle, it’s fairly unlikely you’ll truly lose your entire premium.

The Similarities Between a Strangle and a Straddle

-

Each are Outlined-Threat Choices Spreads

Each the straddle and strangle contain shopping for two totally different choices with out promoting any choices to offset the premium paid. So essentially the most you possibly can lose in both a straddle or strangle is the premium you paid.

A defining trait of many defined-risk, lengthy choices methods is the convexity afforded to you; the utmost you possibly can lose is X, however your upside is theoretically limitless. This may in fact result in occasional huge wins the place the market mainly tendencies in your route till expiration.

-

Each Are Market-Impartial

Choices assist you to categorical a extra numerous array of market views than merely lengthy or brief. A kind of is the flexibility to revenue with out having to foretell the route of worth.

Whereas market-neutral is a simple time period to make use of as a result of most perceive it off the bat, that’s not fully right. You’ll be able to extra precisely name straddles or strangles delta impartial technique as a result of when you’re impartial on the route of worth, you’re nonetheless finally taking some form of market view.

Within the case of straddles and strangles, you’re taking a view on whether or not volatility will develop or contract. Or in different phrases, do you’ve conviction on whether or not the market will transfer roughly than the choice market thinks? If that’s the case, you possibly can revenue from this view.

Put merely, in the event you anticipate the underlying to get extra risky earlier than expiration, you need to be lengthy volatility. Taking a protracted volatility view assumes that the choices market’s implied volatility forecast is just too low, making choices too low-cost.

Expressing a protracted volatility view within the context of a straddle or strangle means taking the lengthy facet of the commerce (shopping for the choices as a substitute of shorting them).

Simply as we described within the intro of this text, in the event you maintain the view that the market is overhyping the importance of a catalyst, you make the identical commerce in reverse; you possibly can brief an at-the-money put and an ATM name, which is a brief straddle. If realized volatility is decrease than implied volatility, then you definately’ll find yourself pocketing a superb portion of premium once you shut the commerce.

The Variations Between a Strangle and a Straddle

Straddles and strangles categorical very comparable views; merchants utilizing them are both expressing a protracted or brief volatility whereas remaining agnostic on worth route. The place they differ is the magnitude of their view, or how fallacious they suppose the market pricing of implied volatility is.

From the long-volatility perspective, it’s cheaper to purchase a strangle since you’re shopping for OTM choices however the dilemma is that with cheaper OTM choices, you’ve a decrease chance of taking advantage of the commerce. The market wants to maneuver extra to place you within the cash.

In case you flip this dilemma to the brief facet, you’ve the identical downside. When shorting strangles, you’ve a excessive chance of accumulating the complete premium on the conclusion of the commerce, however when the market does make an enormous transfer, you expertise an enormous loss. So you possibly can rack up a number of wins in a row solely to see one loss knock out all of those positive aspects.

ATM Straddles Have Extra Premium Than Strangles

At-the-money choices have extra premium than OTM choices. So it follows that the straddle, a selection with two ATM choices, would have much more premium than one with two OTM choices, the strangle.

Because of this, systematic sellers of premium, what you would possibly name the “Tastytrade crowd,” actually like straddles for his or her excessive premium properties. This property of upper premium doesn’t make the straddle superior for premium sellers, as there’s no free lunch–premium sellers are paying for this larger degree of premium with a decrease win fee on their trades.

Straddles Have a Larger Likelihood of Revenue

As it would’ve grow to be clear all through this text, developing choices spreads is all about tradeoffs. Need to put out a small quantity of capital with the potential for an enormous win? You are able to do that, however you’ll hit on these trades a small portion of the time. Likewise, if you wish to revenue on most of your trades, you’re basically paying for that within the sense that your frequent winners will probably be small income and your rare losers will probably be a lot greater.

This dynamic applies equally to the selection between straddles and strangles. A straddle requires extra premium outlay with the next chance of profiting the commerce, whereas strangles allow you to danger much less total on the commerce, however it’s a must to be “extra proper” in your market view to make a revenue.

Your selection between these spreads once you need to make a market-neutral wager on volatility finally comes all the way down to your personal buying and selling temperament, in addition to which unfold makes extra sense given your market view.

Backside Line: Straddles and Strangles Are About Volatility

For many merchants, their introduction to choices is expounded to an attraction to the leverage and convexity for his or her directional market bets. However as they peel the layers away and be taught in regards to the true nature of choices, they be taught that they’re excess of instruments to get leveraged publicity to a inventory or index.

The primary and best lesson is the time side. The longer-dated the choice, the extra it prices. Optionality prices cash. That is very simple to understand. One-year choices ought to price greater than one-day choices.

The subsequent step is knowing how market volatility pertains to possibility pricing. It’s far much less intuitive.

However, think about this hypothetical…

You’re provided the selection between paying the identical worth for a one-month at-the-money possibility on two totally different shares.

One is extremely risky and ceaselessly swings 10% day by day. Tesla (TSLA) is an efficient instance.

The second inventory is a steady blue chip inventory that doesn’t transfer round that a lot. Assume one thing like Walmart (WMT) for example.

Most would accurately select the risky inventory. It’s frequent sense, proper? In any case, a inventory like Tesla can transfer up or down 30% in a month, whereas a inventory like Walmart usually swings lower than 10% in a month.

So like time, volatility has a worth. However as a result of future volatility is unsure, that worth is dynamic and topic to the opinion of the market. Like all market worth, there are at all times opportunistic merchants who revenue from the inefficiencies of market pricing.

That is the place volatility buying and selling is available in. Consider strangles and straddles because the hammer and drill of volatility buying and selling. They’re traditional instruments you attain for over and over.

Bear in mind, everytime you purchase or promote an possibility, you’re making an implicit wager on volatility, whether or not you prefer it or not. In case you purchase an possibility, you’re taking the stance that volatility is just too low-cost.

Associated articles