Have you ever ever thought of how massive the primary million truly is? A million greenback payments, stacked on high of one another (at a thickness of .0043 inches per invoice), would attain over 350 ft excessive. A million miles would get you to the moon and again (twice) with a bit of bit further to spare. A million minutes is almost two years. As you may see, 1,000,000 is a really massive quantity.

In terms of turning into a millionaire, the trail is totally different for everybody. Should you aren’t blessed with extraordinary athletic capability, wealthy dad and mom, or a killer enterprise concept, you may probably should take a gradual and regular path to make your million.

With a bit of information and self-discipline, most individuals can grow to be millionaires (particularly for those who begin younger!)

Saving Your Means To $1,000,000

Let’s check out how lengthy it would take you to accrue a million {dollars}. Should you save $50 each single day for 50 years, you continue to will not have 1,000,000 {dollars} on the finish of your financial savings.

You may truly solely find yourself with $912,500, and that is not even accounting for the truth that due to inflation, your million {dollars} will not be price almost as a lot as it could be price as we speak.

How Compound Curiosity Works

There’s a neater strategy to save your strategy to $1,000,000 by the ability of compound curiosity. Compound curiosity is an idea the place your preliminary funding grows over time. However every time your funding grows, you get extra progress on high of your preliminary features. This makes your funding develop at a quicker and quicker clip yearly.

Would you moderately have a penny that doubles every day for a month

or $1 Million?

Whereas it turns into very tough to save lots of your strategy to $1,000,000 by retaining your cash in your sock drawer or underneath your mattress (primarily a 0% return), by investing properly, 1,000,000 {dollars} is extra simply in attain.

Investing Your Means To $1,000,000

There are two essential elements that may decide how lengthy it’d take to speculate your strategy to $1,000,000.

The primary is what number of years you’ve got earlier than you wish to grow to be a millionaire and the second is the return that your investments earn.

The extra time you must save and make investments, the decrease return that you will want. Equally, the upper the return that your investments earn, the less years it would take to grow to be a millionaire. We’ll discover this a bit extra within the subsequent part.

How A lot Do You Want To Save To Be A Millionaire

Earlier than asking your self “How a lot do I want to save lots of to be a millionaire,” it is a good suggestion to take a step again and assess your objectives. This can assist you determine how possible your plan is, and the way aggressive you may should be together with your saving and investing technique.

If you wish to be a millionaire by 25, you may want a distinct plan than for those who’re simply eager to earn 1,000,000 by the point you retire.

This is a chart displaying how lengthy it would take you to earn $1,000,000 by saving $500 monthly at totally different charges of return.

This desk makes it very clear the significance of investing your cash. Should you preserve your cash underneath your mattress (0%), your probabilities of saving 1,000,000 {dollars} earlier than you die are fairly low.

Even in case you have your cash invested in a financial savings account or CD (2% return for those who’re fortunate), it would take fairly a very long time.

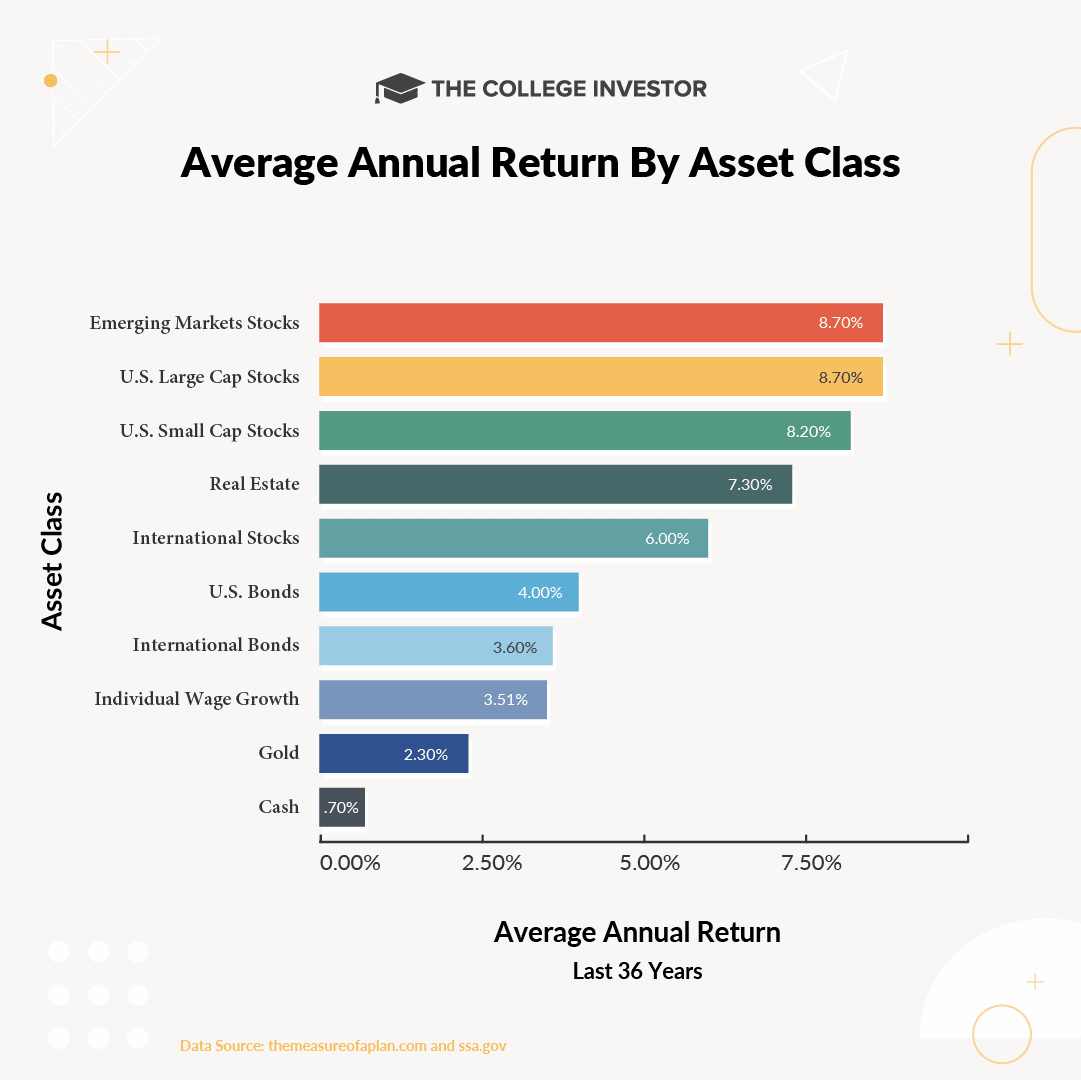

As you begin incomes larger returns, for instance, in an index fund, the variety of years begins lowering to a extra cheap stage. For instance, you may see within the chart under that shares have the potential to return 8% per 12 months on common, the place money is close to the underside at lower than 1%:

This is one other approach to have a look at it. This desk outlines a constant price of return at 8% and exhibits how a lot you may want to save lots of every month, relying on what number of years you’ve got till you wish to be a millionaire.

As you may see, beginning younger and having an extended time horizon actually makes an enormous distinction.

Consider additionally that every one of those numbers are usually not accounting for inflation and the very actual proven fact that $1,000,000 in 30 or 40 years won’t have the identical buying energy because it does as we speak.

The Backside Line

So, are you able to save your strategy to $1,000,000? Sure, you may, however there’s a number of issues that you are able to do to make your life simpler.

The primary is the significance of investing and incomes a very good return in your cash. Should you make investments at 0% to 2%, your odds of ever turning into a millionaire are fairly low.

However for those who can earn 7% to 10% in your cash, even a modest quantity of month-to-month financial savings can add up fairly shortly.

Begin early—the extra time you’ve got, the higher your probabilities of saving your strategy to 1,000,000 are.