Mint was one of many earliest free budgeting apps obtainable on-line, and it just lately introduced it might be shutting down. Consequently, thousands and thousands of individuals are on the lookout for Mint alternate options.

Mint is not going away altogether, however slightly migrating their customers into Credit score Karma – one other platform, however with far fewer budgeting instruments. As an alternative, Credit score Karma focuses on credit score constructing – not essentially what most Mint customers are on the lookout for.

We have reviewed all the preferred budgeting apps obtainable, and listed here are our picks for one of the best Mint.com alternate options.

Options Of Mint

Mint was one of many first budgeting apps I ever used. It was free, it linked to your entire accounts and downloaded the transactions, and helped you categorize and observe your spending.

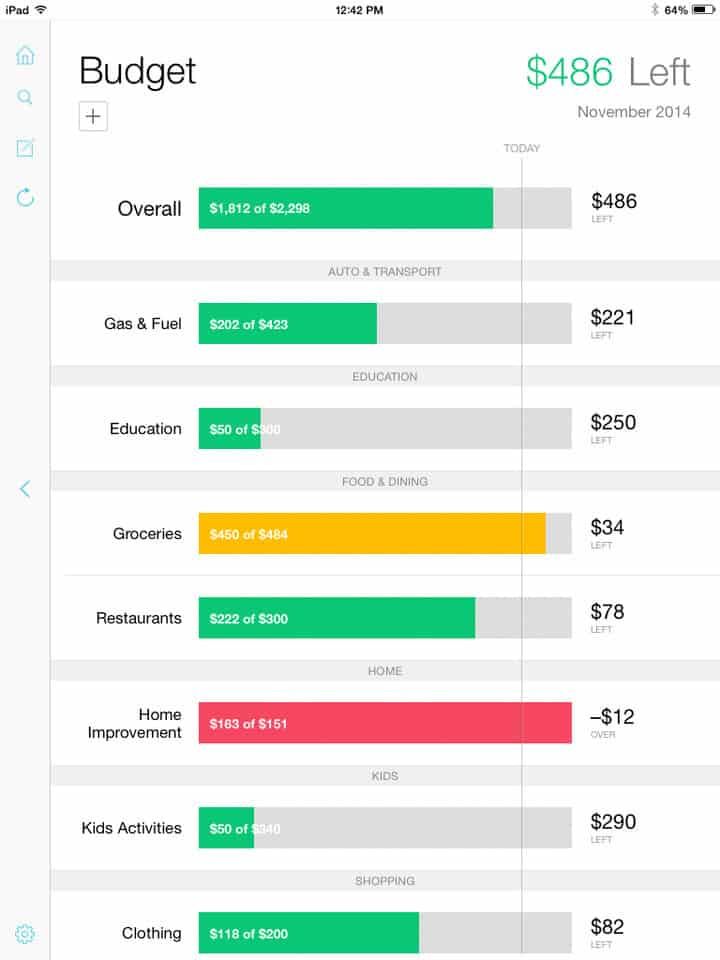

This is a enjoyable screenshot from means again once I first began utilizing Mint (test that date out).

When you’re on the lookout for a Mint alternative, likelihood is you are on the lookout for the next choices:

It is vital to do not forget that FREE goes to be laborious to come back by. When you’re utilizing a free service, likelihood is YOU are the product. In Mint’s case, Mint would promote to you primarily based in your knowledge. For instance, encourage you to signup for a bank card.

Many providers in the present day deal with privateness – and because of this, they may cost you a month-to-month subscription. What does your subscription go in the direction of? Properly, connecting to banks and brokerages prices these firms cash (normally about $0.10 to $0.50 per account per 30 days). Plus, these firms should pay builders, customer support, and extra. Having a free product is tough to do all of this with promoting {dollars} alone.

Mint Options

With these key options in thoughts, listed here are our picks for one of the best Mint alternate options in the present day. We have reviewed all these services and products (and all of our staff makes use of not less than certainly one of these repeatedly).

1. Empower

Empower (previously referred to as Private Capital) is a good monetary dashboard that connects your entire accounts, and means that you can observe your spending.

Budgeting is not as robust as some others on this listing, however the software is FREE. The downside of being free is that they may attempt to upsell you into their funding administration (which they do cost an annual payment for – a share of belongings beneath administration).

If you’re eager to view your investments and perceive how nicely they’re performing, that is the place Empower shines. You possibly can join free and sync your funding accounts. Or sync all accounts if you wish to see your web price.

Learn our full Empower (Private Capital) evaluate.

2. YNAB

YNAB stands for You Want A Finances. Budgeting is all of it YNAB does. It’s additionally superb at it. YNAB makes you give each greenback a job. This implies you assign every greenback of earnings to a class, just about reducing out any likelihood that you just’ll spend cash spontaneously.

Classes are setup to group bills. When you occur to go over in a single class, you possibly can take from one other class to cowl the distinction.

Ultimately, the purpose with YNAB is that you’re dwelling off of the earlier month’s earnings. The best way you get there may be by way of constant use of YNAB and ensuring you comply with its guidelines, which is troublesome to not do.

YNAB could be put in as a desktop app on Home windows or Mac, cellular app on Android or iPhone or just run it from the online. It provides a 34-day trial and thereafter will price $98.99/yr. YNAB is ready to justify this price by way of the quantity you’ll save by utilizing the software program.

Learn our full YNAB evaluate.

3. Monarch Cash

Monarch has been constructing an incredible budgeting and web price monitoring app that mixes all of the options we love – transaction categorization, web price monitoring, and funding monitoring. The truth is, the founder was one of many authentic staff members at Mint.

And in contrast to among the different apps that join and replace your accounts mechanically, Monarch really works! We hardly ever see connectivity points or issues.

It is a paid app although, and you are going to be paying $9.99 per 30 days or $89.99 yearly.

Learn our full Monarch evaluate right here.

4. Copilot

Copilot is without doubt one of the newer apps on our listing, however they’ve been creating an awesome budgeting and monetary monitoring app. It provides nice connectivity, nice visualizations, and is without doubt one of the few apps that additionally helps cryptocurrency. It additionally appears wonderful.

The one downside proper now could be that this app is barely obtainable for Mac and iPhone (which, truthfully, is fairly uncommon as most apps favor PC).

Copilot is a paid app. You get 60 days free with promo code TCI2023, then it prices $8.99 per 30 days or $69.99 per yr.

Learn our full Copilot Cash evaluate right here.

5. Quicken Simplifi

|

Quicken Simplifi Options |

|

|---|---|

Simplifi is app-based, targeted on budgeting and spending monitoring, and has a pleasant consumer interface. One of the best options of Simplifi embrace its spending monitoring and watch listing for sure spending classes.

When you’re on the lookout for an app targeted on expense monitoring, Simplifi is a good possibility.

Simplifi is from Quicken, which is a frontrunner in private finance software program. It is vital to notice that Quicken used to be a part of Intuit, however they had been spun off and have become their very own firm in 2016. So should you’re frightened about this firm dealing with the identical points as Mint, they are not a part of the identical agency.

Learn our full Simplifi evaluate right here.

6. EveryDollar

EveryDollar is the budgeting app created by Dave Ramsey’s firm. Just like YNAB, EveryDollar follows the zero-sum budgeting idea, which is similar as “give each greenback a job”.

EveryDollar has free and paid variations. The paid model has a 15-day trial and price $99/yr. With out the paid model, you possibly can’t sync your accounts, which implies you’ll should manually enter in each transaction. The paid model pulls them in mechanically.

And despite the fact that Dave Ramsey may be very towards bank cards, you possibly can hyperlink your bank card accounts on this app.

Learn out full EveryDollar evaluate right here.

7. Tiller

Tiller Cash is the Mint various should you’re a spreadsheet junkie. Tiller takes private finance, budgeting, and funding monitoring, and helps you set it right into a spreadsheet, and maintain it up to date.

Tiller permits for full customization inside Excel or Google Sheets, but additionally has a wide range of starter-spreadsheets that you should utilize to get began straight away.

What’s wonderful is that Tiller has discovered how you can make your spreadsheets dynamically replace, and so they connect with your financial institution and brokerage and import the newest knowledge. That is wonderful.

Learn our full Tiller Cash evaluate.

8. Qube Cash

Qube Cash isn’t only a checking account. And it’s not only a budgeting app. It’s each, rolled into one. Customers can deposit cash into an FDIC-insured Qube Account. Then, you possibly can design a plan to allocate funds amongst completely different digital envelopes or “Qubes.” You should use among the pre-generated classes or you can also make your individual.

This technique is predicated on the zero-based budgeting system acquainted with apps like YNAB and EveryDollar. Nonetheless, they take issues one step farther by permitting you to hyperlink your debit card to the suitable “Qube” or envelope. Consequently, you have got an entire system setup round your budgeting and spending.

Learn our full Qube Cash evaluate.

9. CountAbout

CountAbout is an internet and app-based fundamental budgeting app. It merely connects together with your financial institution accounts, syncs your data, after which helps you observe and handle your spending habits.

CountAbout will analyze your spending and show it in an easy-to-understand graph. CountAbout enables you to “memorize” transactions, which is one other means of analyzing spending habits.

Like most individuals utilizing price range software program, in case you are presently utilizing Quicken or Mint.com, you possibly can import transactions from each apps, permitting you to begin from the identical place in CountAbout.

CountAbout provides two plans: Primary for $9.99/yr and Premium for $39.99/yr. The Premium plan enables you to mechanically obtain and import transactions out of your monetary establishments. You too can import from Quicken and Mint.

Learn our full CountAbout evaluate right here.

10. Constancy Full View

|

Constancy Full View Options |

|

|---|---|

Constancy (sure, the foremost brokerage firm) has a hidden software many do not learn about – Full View. It is a free resolution for Constancy prospects who wish to observe their spending.

With Full View, you possibly can join your non-Constancy accounts (like banks, bank cards), after which see a full image of your web price and transactions. Constancy additionally permits fundamental categorization of your spending so that you could see what you have spent.

The place it shines is that it integrates with all of Constancy’s full monetary planning options.

Learn our full Constancy evaluate.

How Do You Decide The Proper Budgeting App?

How do you decide the proper budgeting app as an alternative choice to Mint? It actually relies on your type and what you are on the lookout for.

We break down most apps into three key areas:

- Budgeting

- Web Value Monitoring

- Money Move Planning

Relying on what you want, you would possibly favor an app that is robust in a single or the opposite. Additionally, your persona performs an enormous position. Would you like a strict app that follows a zero-based budgeting philosophy? Or would you like an app that is spreadsheet primarily based? Or are you extra targeted on investments and long-term planning?

All of these items play a task in choosing the right budgeting app.

Last Ideas

As you discover the proper Mint Different, remember to export your Mint Information. Many of those apps assist you to import your previous transactions, in order that makes switching straightforward! Try this information to exporting your Mint knowledge.

Additionally, as you strive these apps, ensure you’re checking the Plaid Dashboard and eradicating entry to any previous apps or accounts you now not use. This makes it straightforward to maintain your data considerably protected from advertising and different makes use of.