The primary knowledge is now obtainable for the way scholar mortgage debtors are doing with scholar mortgage repayments restarting.

The U.S. Authorities Accountability Workplace (GAO) has revealed preliminary observations on borrower reimbursement after the tip of the cost pause and curiosity waiver. Extra historic knowledge was obtained from the Federal Pupil Mortgage Portfolio part of the FSA Knowledge Middle.

Though the quantity of debtors who’re present on their federal scholar loans is larger now than earlier than the pandemic, the share of debtors in reimbursement who’re present is decrease. That is partly as a result of the 12-month on-ramp briefly suppressed reimbursement exercise by almost 10 million debtors and partly as a result of extra debtors have been added to the federal scholar mortgage portfolio for the reason that begin of the pandemic.

As well as, extra debtors qualify for a zero cost below the SAVE reimbursement plan than below the REPAYE plan, as a result of the discretionary earnings threshold elevated from 150% to 225% of the poverty. Debtors with a calculated cost of zero rely as present on their loans.

Let’s dive into the information and see how debtors are responding to the restart of scholar mortgage funds.

Historical past Of The Pupil Mortgage Cost Pause And Curiosity Waiver

Part 3513 of the Coronavirus Support, Reduction, and Financial Safety Act (CARES Act) [3/27/2020, P.L. 116-136] licensed a cost pause and curiosity waiver on federal scholar loans. The cost pause was retroactive to March 13, 2020 and expired on September 30, 2020.

The cost pause and curiosity waiver was prolonged a complete of eight occasions, two occasions by President Trump and 6 occasions by President Biden. President Trump prolonged the cost pause by way of December 31, 2020 and January 31, 2021. President Biden prolonged the cost pause by way of September 30, 2021, January 31, 2022, Might 1, 2022, August 31, 2022, December 31, 2022 and September 30, 2023.

The January 31, 2022 and December 31, 2022 extensions have been recognized because the “last” extensions, however have been adopted by extra extensions.

Additional extensions have been blocked by the Fiscal Duty Act of 2023 [6/3/2023, P.L. 118-5], which scheduled the restart of reimbursement for 60 days after June 30, 2023. Curiosity started accruing on September 1, 2023 and reimbursement restarted in October 2023.

The cost pause lasted greater than three-and-a-half years, a complete of 1,297 days (42 months and 18 days). Greater than $208 billion in curiosity was waived throughout the cost pause.

Pupil Mortgage On-Ramp Interval

The U.S. Division of Training was involved concerning the challenges of restarting reimbursement after so a few years of non-payment, in order that they applied a 12-month “on-ramp” to guard debtors from damaging credit score reporting in the event that they did not make funds.

Usually, federal scholar mortgage debtors are reported as delinquent to the three credit score bureaus when they’re greater than 90 days past-due.

In the course of the 12-month on-ramp, nonetheless, the U.S. Division of Training applied retroactive administrative forbearances when debtors have been 90 days overdue. Curiosity continued to accrue throughout these forbearances, however about 6.7 million delinquent debtors have been shielded from damaging credit score reporting.

Recent Begin Initiative

The U.S. Division of Training additionally applied the Recent Begin Initiative, which restores defaulted debtors to a present standing with out requiring them to rehabilitate the loans by consolidating them or making plenty of on-time voluntary funds. Technically, the cost pause counted as if the debtors had made the on-time funds required by mortgage rehabilitation.

The Recent Begin Initiative eliminated the default from the borrower’s credit score historical past. It additionally suspended enforced assortment strategies for defaulted federal scholar mortgage debt, akin to wage garnishment and Treasury offset of earnings tax refunds and Social Safety incapacity and retirement profit funds.

7.8 million debtors have been in default previous to pandemic. After implementation of the Recent Begin Initiative, 6.0 million debtors are in default.

Present Standing Of Federal Pupil Loans

The next tables present the standing of excellent federal schooling mortgage debt as of January 2024. It is essential to notice that whereas scholar mortgage repayments resumed in October 2023, mortgage servicer points did depart debtors in administrative forbearance for months.

For debtors who have been present on their scholar loans, this is what their funds regarded like.

Particularly, 14% of all Federal scholar mortgage debtors, or 4.5 million individuals, had mortgage funds equal to $0 per thirty days. This additionally represents 30% of all Federal scholar mortgage {dollars}. The big enhance in $0/mo funds can be the reason for an 80X rise in the price of the scholar mortgage program.

Previous-due debtors included debtors who have been a number of days late. Six million debtors, or 60% of the past-due debtors, have been 91-120 days overdue. These debtors represented many of the 6.7 million debtors ($186 billion) within the on-ramp who have been shielded from damaging credit score reporting. The breakdown of past-due debtors have been as follows:

- 1 – 30 Days Late: 2.4 million (24%)

- 31 – 60 Days Late: 0.8 million (8%)

- 61 – 90 Days Late: 0.8 million (8%)

- 91 – 120 Days Late: 6.0 million (60%)

Pupil Mortgage Reimbursement Plan Selections

This desk reveals the distribution of debtors amongst reimbursement plans.

|

Reimbursement Plan (Jan 2024) |

||

|---|---|---|

For debtors within the SAVE reimbursement plan, this is what the funds seem like:

For debtors in different IDR reimbursement plans, this is what the funds seem like:

Observe that solely 6.2 million (85%) of the debtors and $333 billion of the {dollars} (84%) within the SAVE reimbursement plan had a scheduled cost as of January 31, 2024, together with a zero cost. Likewise, 4.3 million of the debtors (78%) and $257 billion of the {dollars} (85%) in different IDR plans had a scheduled cost.

Total, 44% of debtors and 36% of {dollars} in IDR plans, together with the SAVE reimbursement plan, had a zero month-to-month cost.

⚠︎ SAVE Pupil Mortgage Reimbursement Plan Lawsuits

Two lawsuits have been filed to dam implementation of the SAVE reimbursement plan. One succeeded in getting a preliminary injunction, pending enchantment. In consequence, the U.S. Division of Training positioned the 8 million debtors within the SAVE reimbursement plan in an interest-free forbearance on July 19, 2024.

- 11 Republican states filed a lawsuit within the U.S. District Courtroom for the District of Kansas on March 28, 2024, in search of to dam implementation of the SAVE reimbursement plan. The Kansas courtroom issued a ruling on June 24, 2024, blocking the components of the ultimate rule that had not but gone into impact. On June 30, 2024, the U.S. Courtroom of Appeals for the tenth Circuit issued a keep of the Kansas courtroom ruling pending enchantment.

- 7 Republican states filed a lawsuit within the U.S. District Courtroom for the Japanese District of Missouri on April 9, 2024, opposing the SAVE reimbursement plan. The Missouri courtroom issued a ruling on June 24, 2024, blocking the forgiveness a part of the rule. After the tenth Circuit appeals courtroom choice, the plaintiffs appealed the Missouri ruling to the U.S. Courtroom of Appeals for the 8th Circuit, in search of to dam the whole rule. On July 18, 2024, the U.S. Courtroom of Appeals for the 8th Circuit issued a keep blocking implementation of the SAVE reimbursement plan. The 8th Circuit subsequently changed the stick with a preliminary injunction on August 9, 2024. The U.S. Division of Justice filed an emergency utility to the U.S. Supreme Courtroom on August 13, 2024, asking the courtroom to vacate the 8th Circuit’s injunction after the 8th Circuit refused to make clear whether or not its ruling utilized solely to the SAVE reimbursement plan and never all income-driven reimbursement plans.

- The U.S. Supreme Courtroom denied the request to vacate the injunction on August 28, 2024.

Standing Of Federal Pupil Loans In contrast To Pre-Pandemic

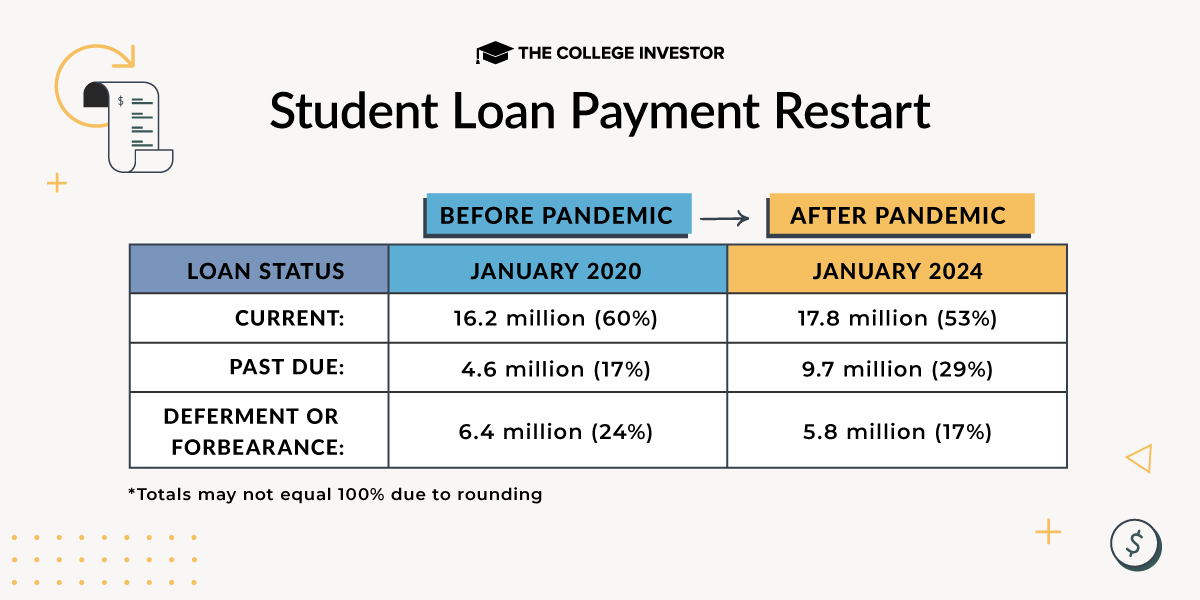

The next tables present the standing of excellent federal schooling mortgage debt earlier than and after the pandemic. This evaluate the reimbursement standing of Federal scholar loans in January 2020 (from earlier than the pandemic) to January 2024.

Though the variety of debtors who’re present elevated, the proportion decreased, partially as a result of the variety of debtors in reimbursement elevated by greater than 5 million. The variety of debtors in reimbursement consists of debtors who’re present, overdue, in deferment and in forbearance.

The variety of debtors who’re overdue doubled, partially as a result of on-ramp.

The distribution of debtors by mortgage standing is more likely to change considerably after the on-ramp expires on September 30, 2024. A few of these debtors will begin repaying their scholar loans and a few will acquire a deferment or forbearance, with the remaining remaining in a past-due standing.

This reimbursement habits is healthier than anticipated regardless of the extended interval of the cost pause.