We’re approaching the tip of the 12 months, so now’s the time to make plans to avoid wasting in your taxes and affect your tax state of affairs.

I am not speaking about going Donald Trump-style and shedding numerous cash to offset your beneficial properties. I am speaking about some sensible actions you’ll be able to take right now that may decrease your tax invoice for the 12 months.

So, with out shedding a bunch of cash, listed below are ten alternative ways that you would be able to save in your taxes earlier than the tip of the 12 months.

1. Enhance Your 401k Contribution

The most effective methods to avoid wasting in your tax invoice right now is to contribute to your 401k or 403b. These accounts assist you to save pre-tax cash for retirement. The end result? You pay much less in taxes right now as a result of the cash grows tax free till you withdraw it in retirement.

For 2024, the 401k contribution restrict is $23,000, however in the event you’re over 50 years outdated, you may make a further $7,500 catch up contribution.

For those who’re not on the restrict but, including to your 401k is a good way to economize AND save in your taxes.

And bear in mind, the 401k contribution limits change every year, so test them out right here: 401k Contribution Limits.

2. Max Out Your Conventional IRA

Alongside the identical strains as a 401k, you’ll be able to contribute to a standard IRA and decrease your taxable revenue. Deciding whether or not to contribute to a Roth or Conventional IRA could be robust, however in the event you’re enthusiastic about simply this 12 months’s taxes, then utilizing a standard is the best way to go.

For 2024, you’ll be able to contribute $7,000 to an IRA in the event you’re beneath age 50, and $8,000 in the event you’re over age 50.

And bear in mind, whereas there are not any revenue limits to contribute to a standard IRA, there are revenue limits that may forestall you from deducting your contribution.

Study in regards to the IRA contribution and limits right here.

3. Max Out Your SEP IRA Or Solo 401k

For those who’re a facet hustler, it is important that you just make the most of a SEP IRA or Solo 401k to decrease your taxable revenue. Aspect hustles are nice (and this is an inventory of fifty you’ll be able to attempt), but it surely’s vital to do not forget that most of that revenue would not have taxes withheld, so you are going to face a big tax invoice in your facet hustle cash.

By contributing to a SEP IRA or Solo 401k, you’ll be able to defer a few of that cash into the long run and keep away from paying taxes on it right now. It is a good way to, not solely save, however to decrease your tax invoice this 12 months.

Contributing to a SEP IRA is straightforward, and you are able to do so all the best way till April 15. Establishing a solo 401k is a bit tougher, and you must have your plan setup by the tip of the 12 months to have the ability to contribute to it. However you can too save a LOT extra money.

In 2024, with a SEP IRA, it can save you 25% of your revenue, as much as $69,000 per 12 months. With a Solo 401k, it can save you as much as $69,000 per 12 months as nicely!

4. Max Out Your HSA

We’re enormous followers of utilizing your Well being Financial savings Account to avoid wasting for retirement. If in case you have the power to max out your HSA this 12 months, just remember to contribute as a lot as potential. And bear in mind, in the event you can afford it, do not get your reimbursements this 12 months. Save your receipts and let the cash in your HSA develop for you.

A reminder – the HSA is like your IRA, and you’ll really make your 2024 contributions all the best way till April 15, 2025.

In 2024, you’ll be able to contribute as much as $4,150 in the event you’re single, and $8,300 in the event you’re a household. For those who’re over 55, you additionally get a $1,000 catch-up contribution. Learn the total HSA Contribution Limits right here.

5. Save For Your Youngsters’s School

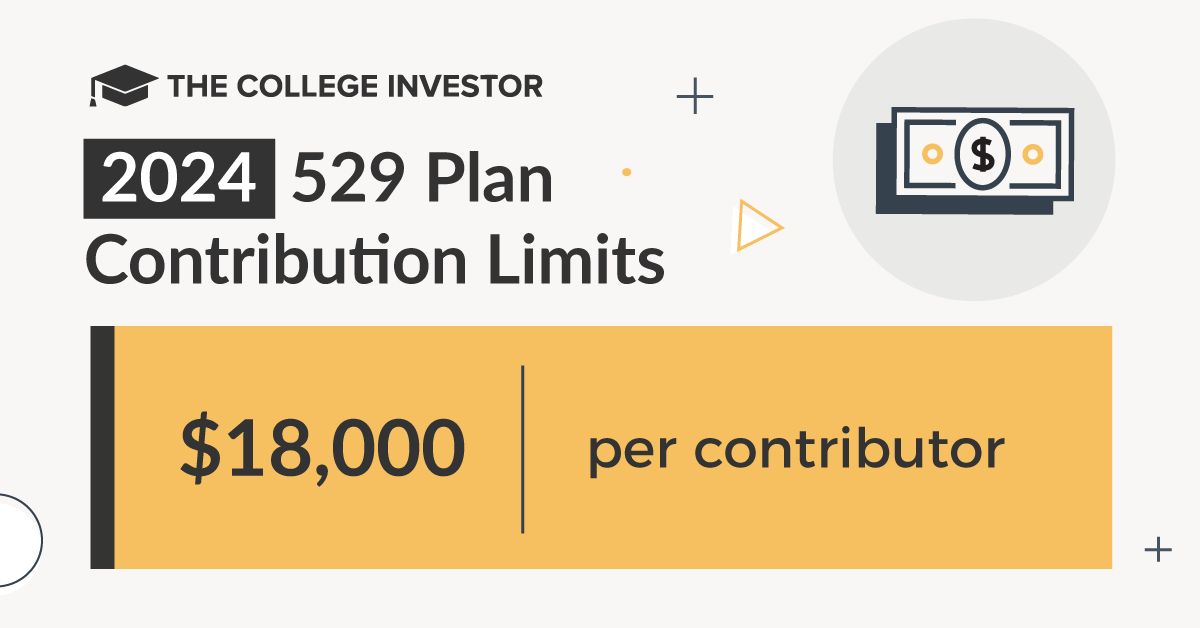

Contributing to your kid’s 529 plan is a good way to avoid wasting for faculty, but it surely’s additionally a possible tax profit to you. For those who reside in one of many 32 states that gives tax deferred 529 plan contributions, this may be a good way to decrease your state revenue tax invoice.

Whereas the Federal authorities would not provide any deductions for contributing to a 529, many states do.

Contributions to a 529 plan are thought-about presents, and so the bounds for contribution are primarily based on the reward tax exemption.

You possibly can contribute as much as $18,000 per youngster, per 12 months, per particular person gifting. So, married {couples} might contribute $36,000 per youngster, per 12 months. There’s additionally a 5 12 months contribution rule, the place you may give a full $90,000 per youngster in a single lump sum, and it counts as a contribution for the subsequent 5 years.

Study extra about 529 Plan Contribution Limits right here.

6. Make Power Environment friendly Enhancements To Your Dwelling

For those who make power environment friendly enhancements to your property, you’ll be able to qualify for tax credit that may assist you save in your taxes this 12 months.

In 2024, you’ll be able to stand up to $3,200 in tax credit, relying on what you do.

The utmost credit score you’ll be able to declare this 12 months is:

- $1,200 for power property prices and sure power environment friendly residence enhancements, with limits on doorways ($250 per door and $500 whole), home windows ($600) and residential power audits ($150)

- $2,000 per 12 months for certified warmth pumps, biomass stoves or biomass boilers

All of those credit will help you offset your revenue and may present nice financial savings. Study extra about these tax credit right here.

7. Maximize Your Work-Associated Expense Deductions

The actual fact is, most individuals are horrible about retaining monitor of their bills. I am not saying that it’s best to spend extra so you’ll be able to deduct your bills – I am merely saying you must maintain monitor and deduct what’s right.

Some work associated deductions that you would be able to doubtlessly take:

- Transportation and journey – mileage is one which lots of people miss or overlook to calculate

- Meals and leisure

- Union {and professional} dues

- Uniforms, in case your employer would not reimburse you and so they cannot be worn exterior of labor

- Work-related instructional bills, particularly if persevering with schooling is required by your job

The identical guidelines apply in the event you work for your self. For instance, in the event you drive for Uber or Lyft, you ought to be retaining correct monitor of your mileage and bills associated to driving. These will all offset your revenue and assist decrease your tax invoice.

So, maintain monitor of your bills and get monetary savings.

8. Donate To Charity

One other nice strategy to save is just by donating to charity. Your donations of each money and issues could be deducted out of your taxes. Nonetheless, for 2024, there isn’t any strategy to declare charitable contributions with out itemizing your tax return.

So, proper now, begin doing a little fall cleansing, get organized, and see what you do not want anymore. Some guidelines of thumb embrace:

- Garments you have not worn in a 12 months

- Outdated youngsters’s garments or toys they do not use anymore

- Objects sitting in your storage unused for a 12 months

Take these things to an area charity, save your receipt, and deduct your donation in your tax return.

9. Promote Your Loser Shares…

Now, I do know I discussed up prime to not be a loser like Donald Trump and take enormous losses merely to keep away from taxes. However…even good traders have poor performing shares. Now’s a good time to take a look at your portfolio and promote some losers to take the capital loss.

This technique is named tax loss harvesting.

It may be an efficient technique, particularly you probably have numerous capital beneficial properties in your portfolio from earlier within the 12 months.

Whenever you do it, be sure you’re being conscious of the capital beneficial properties tax brackets.

However on the flip facet…

10. Wait To Rebalance Your Portfolio

This sounds odd, however wait till the brand new 12 months to rebalance your portfolio. You see, many mutual funds and ETFs pay out their dividends and capital beneficial properties in December. For those who promote your losers on the finish of the 12 months, merely wait till January earlier than deploying that cash.

For those who purchase right into a mutual fund or ETF proper earlier than the distribution, you might be successfully shopping for your self a tax burden. For the reason that distributions are part of the Web Asset Worth (NAV) anyway, you are not lacking a lot by ready only a couple weeks.

This is our information to rebalancing your portfolio throughout a number of accounts.

Issues To Contemplate For Subsequent 12 months

There are some belongings you simply cannot change this 12 months (possibly you’ve got already bought some shares or had different beneficial properties), however proper now’s sometimes open enrollment for many individuals. And which means there are adjustments that you would be able to make for subsequent 12 months.

If decreasing your taxable revenue is a aim for you, take into account making these adjustments throughout open enrollment:

- Maximize Your 401k Contribution

- Select a Excessive Deductible Well being Care Plan with an HSA

- Maximize Your HSA

- If in case you have youngsters, make the most of a Dependent Spending Account for youngster care prices

- For those who commute to work, take into account a Transportation Spending Account if eligible

What else? What are you doing to decrease your taxable revenue every year?