Choices can be utilized to make directional bets on a market, to hedge an extended or quick place within the underlying asset and to make bets on adjustments in implied volatility. Choices will also be used to generate earnings.

One of many largest makes use of of choices is to mitigate threat on an extended place in a inventory or different asset.

Description of the Protecting Put Technique

The protecting put is a comparatively easy buying and selling or investing technique designed to attempt to hedge the danger related to an extended place.

For instance, if a dealer or investor is lengthy 100 shares of inventory ABC, then she or he might search for methods to guard in opposition to a decline within the inventory worth.

The protecting put technique merely entails the acquisition of an extended put choice which will doubtlessly achieve in worth if the inventory worth declines. Right here is a straightforward instance:

Protecting Put Instance

Dealer Joe is bullish on inventory ABC and owns 100 shares at a mean buy worth of $40 per share.

The corporate has a serious earnings announcement arising in a couple of weeks, and Joe needs to hedge his draw back threat within the inventory utilizing protecting places.

With the inventory presently buying and selling at $45 per share, Joe decides to buy the 2 month $40 put choice (ie the strike worth is $42) for a premium of $4.

Protecting Put Instance

If the earnings announcement is taken into account bullish and the inventory worth rises, the put choice can both be offered again to the market at a loss or could be held till expiration.

If the inventory worth is above the choice strike worth of $40 at expiration, then the choice merely expires nugatory and Joe is out the $4 premium paid for the put.

If the inventory worth had been to plummet, nevertheless, Joe’s put might doubtlessly achieve in worth and probably offset some and even the entire losses on the inventory.

If the inventory worth is beneath the choice strike worth of $40 at expiration, then Joe has the fitting to promote his shares at $40 no matter how low the inventory worth goes.

For instance, if the inventory worth declined all the best way to $35 per share, Joe’s losses can be restricted to the $4 choice premium paid per share.

When To Put It On

The protecting put is used to attempt to mitigate draw back threat on an extended place, and can be utilized beneath quite a lot of circumstances. Within the instance used above, the dealer needed to attempt to hedge the draw back threat that might come from a serious earnings announcement.

In one other situation, a long-term investor may regularly buy lengthy places on a inventory place that he believes might see a pointy rise in volatility. Lengthy places are additionally lengthy vega.

In one more case, a dealer or investor might buy a put if implied volatility ranges are very low, thus making the choices comparatively inexpensive.

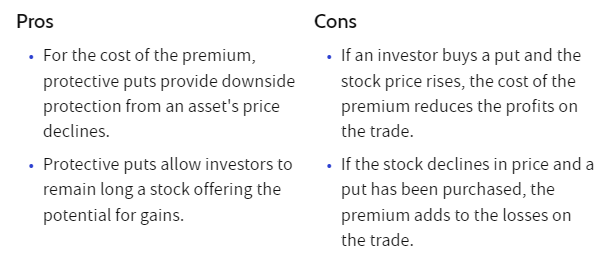

Professionals of Technique

The protecting put’s main function is to hedge draw back threat of an extended place within the underlying asset.

Choices can present a level of safety for an extended place as might also doubtlessly produce a revenue if the shares drop or if there’s a vital enhance in implied volatility ranges.

As a result of the put choice is bought, the danger on the put place is proscribed to the premium paid for the choice.

Cons of Technique

The technique does include some cons as properly. As a result of choices have an expiration date, the choice will lose worth as time passes with all different inputs remaining fixed.

Choices which might be near the present share worth might also be prohibitively costly, forcing the dealer or investor to buy places which might be additional away from the cash.

Though places which might be additional away from the cash might present a hedge in opposition to a serious sell-off, the dealer or investor remains to be uncovered to a level on the inventory.

A put that may be a few {dollars} out of the cash might not achieve sufficient worth to offer a hedge in opposition to a minor to reasonable decline within the inventory.

Danger Administration

Danger administration for a protecting put could be achieved in varied methods.

If one is hedging an extended place, she or he could also be keen to easily maintain the choice till it expires realizing that they are going to lose the whole premium paid.

One other strategy to handle threat could also be to promote the put again to the market if it loses a certain quantity of worth. Some merchants might determine, for instance, to promote a put again to the market if it loses half of its worth.

One other methodology of threat administration might embody rolling the put out to a later expiration date.

Attainable Changes

There are a number of methods to regulate an extended put place. The dealer or investor might initially purchase a put that’s farther from the cash, and roll it nearer to the inventory worth as expiration will get nearer and the choices turn into inexpensive.

One other methodology might be to roll the lengthy put out to a later expiration date utilizing the identical or perhaps a totally different strike worth. The dealer or investor might even determine to unfold the lengthy choice by promoting an out-of-the-money put in opposition to it to decrease the fee foundation.

Utilizing a put to guard an extended place within the underlying is a comparatively easy place, but it surely does include its personal set of dangers.

Merchants and traders should determine how a lot threat they’re keen to imagine on the inventory worth, and should additionally determine what they’re keen to pay for the hedge.

Used beneath the fitting circumstances, the lengthy put can present a level of safety for an extended place, however that potential safety does come at a price.

Backside Line

Protecting places restrict potential losses from proudly owning shares and don’t impression most positive factors from proudly owning shares. Nevertheless, like different varieties of insurance coverage, it’s important to pay a premium to purchase protecting places. Over the long run, shopping for protecting places can drag down your funding returns.

Merchants and traders should determine how a lot threat they’re keen to imagine on the inventory worth, and should additionally determine what they’re keen to pay for the hedge.

Used beneath the fitting circumstances, the lengthy put can present a level of safety for an extended place, however that potential safety does come at a price.

Concerning the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and recently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to convey this data to a wider viewers and based Epsilon Choices in 2012.

Subscribe to SteadyOptions now and expertise the total energy of choices buying and selling at your fingertips. Click on the button beneath to get began!

Be a part of SteadyOptions Now!